About us

Profimex is the private equity real estate arm of Bamberger-Rosenheim Ltd., founded in 1969 by Hella Rosenheim (Bamberger) may her memory be blessed and Elchanan Rosenheim.

Profimex has invested in assets valued at more than $50 billion since its inception. Profimex specializes in diverse, cross-border investments and serves high-net worth individuals (HNWIs), private and public companies, as well as institutional investors. The investment threshold for private investors is between $100,000 and $500,000.

Profimex investments are executed through experienced overseas partners with a proven track record and deep familiarity with their local markets. Its diverse range of investments spans multiple countries, sectors, investment strategies, and structures.

Profimex’s equity and debt investments are implemented through specific projects, co-investments, joint ventures, and funds of funds. Profimex is committed to maintaining an alignment of interests with its investors and adheres to the principle of success based reward for managers in all its investments.

An unprecedented investment environment has been created with the waning of the economic crisis. We believe that now is the time to target attractive investment opportunities. With that being the aim for the future, Profimex and its associates continue to remain vigilant in safeguarding investor interests in existing investments and simultaneously take active measures to salvage investments rendered risky by the economic crisis.

Investment Committee

Profimex’s Investment Committee reviews each investment opportunity that has already passed the meticulous scrutiny of our partners. Profimex has the right of first refusal for each investment opportunity proposed by our partners – this is a basic foundation in maintaining alignment of interests with our investors.

These opportunities are evaluated using an elaborate model that weighs economic indicators and the economic strengths against the risks which provide a unique tool for evaluating each transaction’s feasibility. The model is based on data reported by our local partners and assesses predicted cash flows, leverage, the business plan’s working assumptions, and other key factors.

The committee reviews each potential investment both from a leverage-based analysis and a strictly equity-based analysis. This is done to discount extraneous factors and examine the economic logic behind the fundamental real estate investment more diligently, as the level of leveraging and financing costs have decisive impact on the risk and predicted ROIs.

In addition to specific financial evaluations, the committee’s final feasibility decision is based on a review of the markets’ macro and micro environments, taxation, legal considerations, and all the relevant ramificatios for our investors.

Profimex’s investment committee includes experienced professionals with rich backgrounds in accounting, economics, finance, law, and management. Chairperson Itzik Gidron has dozens of years of experience as a senior executive in local and global firms, taught in academic institutions, and has been a real estate investment manager in Israel and overseas for the past 18 years.

Investing in a project requires a consensus of all the committee members. Profimex’s managing director, Elchanan Rosenheim, has the right to veto committee decisions but is not a member of the committee. This maintains the members’ professional objectivity and prevent any decision-making bias.

Profimex VCA

Profimex VCA (Valuation, Consultation & Advisory) is a Profimex subsidiary providing business, financial, operational and real-estate consultation and support.

Profimex VCA provides its customers with consulting services that are based on field expertise, a comprehensive and integrative perspective, and a strong commitment to achieve effective results.

The consultation process enables customers to identify barriers and other obstacles that stand between the business and its success. Further, the consultation provides focus, purpose, and offers practical know-how and tools that help the business improve its performance and fulfill its goals.

Profimex VCA is headed by Itzik Gidron, who has dozens of years of experience in managerial positions in both public and private companies. The company’s operations are managed with close collaboration and support by Profimex Managing Director Elchanan Rosenheim, who has global managerial and business experience in a variety of areas. Altogether, VCA’s staff includes experts from different disciplines including industrial engineering, law, accounting, economics, and management.

Accumulative Knowledge

Profimex’s experience and knowledge was and continues to be built through its investment in thousands of assets along its 25 years of activity in the global real estate arena with its local partners. This has enabled Profimex to access and execute a myriad of unique private equity opportunities.

By constantly accumulating and processing information, we have been able to maintain the position of a leading knowledge source in our investment areas. Profimex’s strive to be a rich knowledge and information base continues to be achieved becasue of several ongoing processes:

- Constant and consistent learning

- Exposure to professional and academic studies by leading global research organizations

- Identification of investment trends among global institutional investors

- Monitoring of correlations between real estate and other portfolio investment allocations

All of the above are summarized in the Profimex GlobaLink newsletter for investors, and are simultaneously factored into the development of our investment products and the decision-making process in our investment committee.

Profimex does not normally aim or look to interfere in the management of its investments. Profimex performs a rigorous and time-consuming due diligence process in evalutating potential partners. These partners, are experienced and professional real estate investors with many years of activity in their local markets. If Profimex feels the need to actively monitor these partners and the investment, this would generally indicate a mistake has been made in assessing our partners. When we participate in an investment, we believe that we have management partners who will run the business efficiently, prudently allocate capital to grow value, and ultimately seek paths to add value to the investment. In the large majority of our investments, our partners have proven themselves capable. In the exceptional cases we were forced to become involved in management of the investment, we did not spare any efforts or financial resources in order to bring the investment to a safe harbor.

Our Investors

Private Investors

Our private investors are high-net worth individuals (HNWIs) looking for exclusive investment opportunities who are able to meet the entry threshold of $100,000 to $500,000 per individual investment.

Profimex provides investors with access to investments which are not readily available to them as independent individuals, with full transparency and an alignment of interests. Additionally, our investors receive comprehensive updates throughout the investment’s lifecycle, including regular meetings with investment managers. Our investors diversify their portfolios with direct investments as well as investments in funds, which allow for geographical, sectoral, and managerial diversification.

In order to invest with Profimex and its partners, an investor must qualify as an accredited investor. This is defined as an individual with a net worth of at least $1 million, not including the value of one’s primary residence; alternatively, an individual who has an annual income of at least $200,000 (or a combined income of $300,000 together with his/her spouse, if married).

Institutional Investors

Institutions that manage planholder, customer and nostro accounts have invested hundreds of millions of dollars worldwide with Profimex. Institutional investors working with Profimex include insurance companies, pension funds, providence funds, study funds, banks, and public and private corporations all of whom have diversified their portfolios through funds and funds of funds, as well as direct investments.

Profimex specializes in customizing investment solutions for institutional investors’ long-term strategies as well as tailoring investment vehicles to investment communities’ requirements and boards – all subject to regulatory requirements.

Track Record

Data regarding annualized total return from exited investments is available to "Accredited Investors" only, as per the definitions of the Israel Securities Authority.

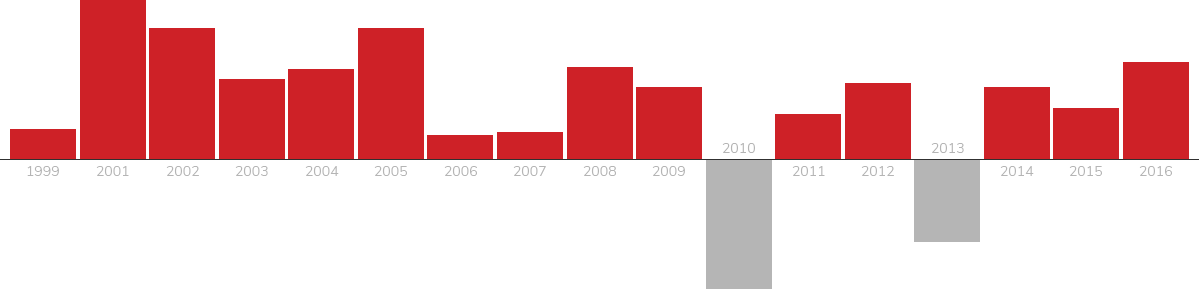

Read moreThe IRR figures represent the annualized total return from exited investments only. Accordingly, IRR figures represent the return that the investor would have earned if he/she invested in all realized investments.

Due to our conservative policy, returns do not include fund investments with remaining unliquidated properties.

PROFIMEX return figures are as of February 2016. There were no exits recorded in 2000.

Private equity real estate investment focuses on value creation over a period several years (generally 3-7). Unlike investments in the capital markets that are generally measured based on short term results, investment performance in real estate should only be judged according to the realization results. In real estate private equity, most of the investment manager’s efforts are driven based on a long term goal as opposed to the short term operating results that shareholders may be interested in. Corporate executives are under constant pressure from investors and shareholders to meet short time earning targets and deliver successful periodic performance reporting. These managers also may have personal interest in the stock price as shareholders or through share price-based incentive compensation. Private equity investors should be aware that interim reporting results do not affect the managers’ compensation and that most of their time and efforts must focus on long term value creation.