Class Asset Strategic a as Estate Real

Real Estate as a Strategic Asset Class

The Benefits of Illiquid Investments

Real estate, a key asset class in a portfolio, can offer stable income returns, partial protection against

inflation, and good diversification with other investments in the portfolio.

An efficient real estate portfolio should include varied regions, sectors and investment strategies. While

most investors still have a major “home bias” in their real estate portfolios, the trend toward a heavier

international focus has been on the rise for some years.

The ongoing near zero-interest rate environment in most industrialized nations poses a variety of challenges

to private and institutional investors, as traditional fixed-income investments do not provide the desired

yield levels as they did in the past. In light of that, the benefits of real estate investments, such as low

correlation to other asset classes and the relatively stable and attractive returns, are more prominent than

ever. Moreover, the real asset element structured in real estate provides investors with stability in the

current environment, which is subject to a number of uncertainties.

Less is More: Private Equity Investments` Benefits

David Swensen, the Chief Investment Officer at Yale University since 1985 and one of the world’s most

appreciated investors, realized decades ago that liquidity is an undesirable feature which should be avoided in a significant part of the portfolio.

Insisting on liquidity results in lower returns, a heavy price paid by the investor. The Yale Model is thus characterized by relatively

heavy exposure to private equity compared to more traditional portfolios, dedicating about 20% of the portfolio to real estate.

Since 1978, the real estate component of Yale’s portfolio has yielded an annual average return of 11.6%.

The inefficiency embedded in the private equity markets creates opportunities for identifying mispriced assets, bearing a potential of

higher returns compared to the capital markets. Liquidity concession in a significant part of the portfolio suits sophisticated investors endowed with a long term view and

ability to stand strongly at times of turmoil in the markets. One must keep in mind that private equity investments, like real estate, do have liquid elements within them, such as distributions originated in rent as well as realizations.

How to Invest in Real Estate?

Investors seeking successful investments in real estate have to cover a wide range of specialist functions

that are needed for implementing the real estate strategy and managing international real estate portfolios.

Since most investors do not have these specific resources, an alternative way to invest is via indirect real

estate investment vehicles, customized real estate mandates, or property clubs. Investing through tradable

vehicles such as REITs is also an option, but the fact that these are liquid investments, that don’t have the

benefit of illiquidity premium and also highly correlated to the stock market, must be taken into account.

Why Invest in Real Estate?

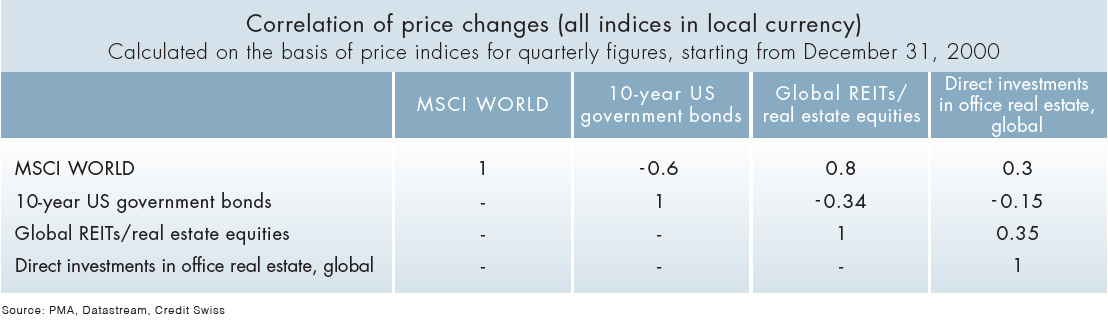

Portfolio Diversification

From a portfolio standpoint, the low correlation with other asset classes is definitely an important

argument for investing in real estate. This means that by adding real estate to an existing portfolio of

equities and bonds, investors can gain diversification benefits. In other words, similar portfolio returns

can be generated with a lower risk, or higher returns can be generated with the same risk.

Diversifying the portfolio between tradable assets such as stocks and bonds in different regions is

no longer as efficient as it used to be. In a global universe, when interest rate trends and countries’

economic shifts immediately affect other countries, the diversification effect becomes significantly lower

and even non-existent. Diversification for the sake of risk reduction still exists effectively as long as the

correlation between the assets in the portfolio is not whole, and even better if it is low or negative, as it

is between real estate and bonds.

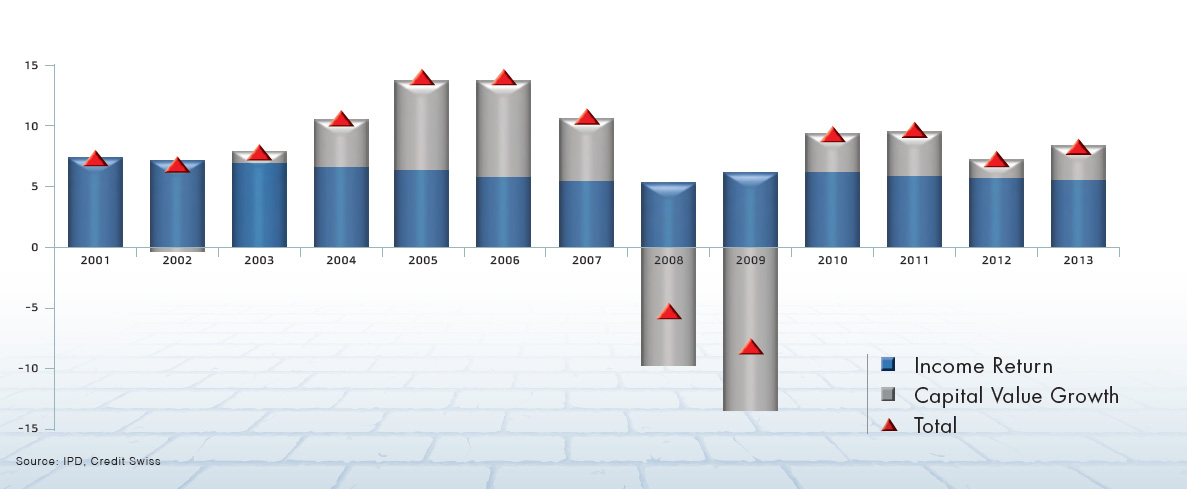

Relatively High, Stable Cash Flow Returns

In a macroeconomic environment of continued low interest rate levels, the advantage of real estate

investments, generating relatively high, stable yields, stands out. Looking at global real estate investment

returns, it is notable that while returns from changes in capital values typically have cyclical fluctuations, the

income yield was 5%-7% and is therefore a stable component of the total returns achieved.

Global Real Estate Returns in % (in local currency)

Hedge Against Inflation

As rental contracts are typically indexed to inflation, real estate investments offer partial protection against rising inflation. The link to inflation can differ depending on the country:

Continental Europe:

In many continental European countries, rents are indexed directly to the Consumer Price Index (CPI), as it

is in Switzerland. Germany has a rent review once inflation crosses a certain threshold. Another option is

partial indexing, as is the case in Italy, for instance. There, 75% of the inflation will impact the rent.

United Kingdom:

Rents are adjusted to inflation or the market typically every five years, whereby rents can only be increased

to positive inflation.

US:

Commercial real estate rents are generally increased annually at a fixed percentage of 2–3%.

Australia:

Leases for shopping malls usually include an annual increase – either a fixed rate of 4-5% or the rate of

inflation plus another 1.0-1.5%. There are various options for rent prices in office and industrial space,

including fixed increases, based on the rate of inflation or a current market analysis.

A Global Portfolio

The global market for commercial real estate in 2011 was approximately USD 26.6 trillion, and by 2021 it will grow by 83% to USD 48.7 trillion. In 2011, the Swiss real estate market accounted for only 1% of the global real estate market, at USD 284 billion. In addition to a geographic distinction of markets, proper diversification of real estate investments also includes examination

of business sectors on which the local economy is based. For instance, markets can be distinguished by whether they are mainly driven by commodities, finance, or government sector. The first category includes cities such as Brisbane, Perth, Calgary, and Santiago de Chile. Markets that largely depend on the financial industry are typically London, New York, and Tokyo, while the commercial real estate demand in cities such as Berlin and Washington D.C. depends stronger on the public sector. The formation of such industry clusters allows us to identify key drivers of each real estate market, to avoid any problematic segments, and to diversify across various industries.

Using Diversification to Reduce Risk

Risks that affect a real estate portfolio can be divided in two:

SYSTEMATIC RISKS

which can’t be reduced by diversification. It is important to note that the globalization process has led to similarities and compatibility in the market cycles of different markets, thus radicalizing this risk.

NON-SYSTEMATIC RISKS

such as demographic changes, inflation, vacancy rates, construction costs, financing costs, etc. These risks, at the market level or the property level, can be reduced by implementing a global portfolio strategy.

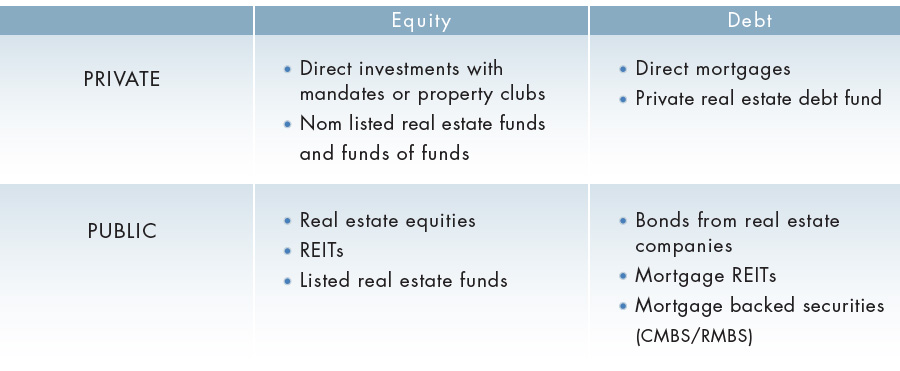

How to Invest in Real Estate?

Investing in real estate can be done in several ways, including investment in the equity segment, the

debt structures, publicly accessible vehicles and private investment opportunities.

Private Investments

Direct investments in real estate assets requires a high equity threshold as well as a wide range of skills,

competencies and resources in order to thoroughly analyze the asset and the market. Investing via a

real estate investment specialist enables a lower equity

threshold whereby due diligence is the specialist’s

responsibility. Investing this way is better done with a local real estate manager with a long proven track

record that includes times of crisis. Investing through a fund or Fund of Funds can also provide the investor

with broader diversification.

Publicly Listed Real Estate Investment Vehicles

Investing in real estate companies’ equities and bonds, as well as in Real Estate Investment Trusts

(REITs), provide investors with liquidity and low investment thresholds but also embedded volatility, as

they are highly correlated to the markets.

In fact, only long term holdings of these kind of investments will simulate private real estate investments

in a portfolio. Therefore, sophisticated investors would prefer the premium embedded in a long term

non-liquid investment.

In a memo published by CitiGroup, the bank’s investment division states that investors harm their long

term returns by over focusing on assets that are too liquid and can be turned into cash at virtually any

time. According to their estimation, investors shouldn’t be afraid of “locking” their money for months or

years in assets such as real estate, defined as less liquid. These non-liquid assets have the potential

of achieving higher yields and can be integrated in investment strategies that are not available

in the public markets.

Real Estate Investment Strategies

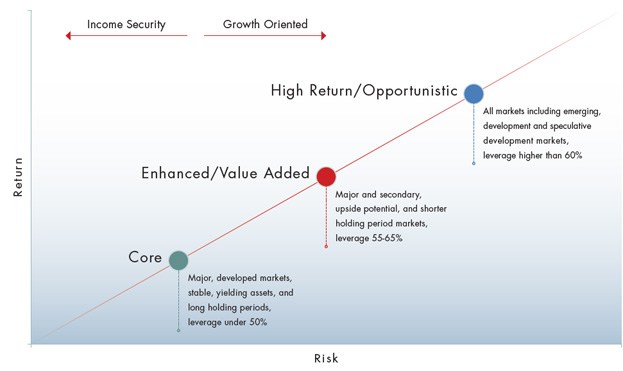

The following graph shows the major real estate investment strategies, classified by Risk/Return Profiles.

The particular characteristics of our strategies may change according to the market environment and

may overlap in specific cases. Choosing the investment style depends on the investor’s objectives and

expectations as well as one’s view on the markets.

Private equity real estate is an inefficient market, where information isn’t exposed to everyone, thus the

investor should aspire to identify the managers’ specific qualifications and ability to produce excess

returns given the inherent risk involved in the investment.

PROFIMEX is the private equity real estate arm of Bamberger-Rosenheim Ltd., established in 1969. We have been adding value to the business community for 47 years with integrity, respectability and full transparency.

Over the past 17 years, PROFIMEX and its private and institutional investors, together with global JV partners, have invested in assets with a total gross value of over $45 billion. Since its inception and as of

December 31, 2014, PROFIMEX has generated an IRR reflecting an average annual return of 12.93%