Profimex Market Review Update – March 22, 2021

22.3.2021

The Suburbs’ Big Moment May Have Passed

A recent survey, conducted by Seyfarth, found that the vast majority (67%) of firms will not shift their workforce to suburban markets or other states, compared to 25% who will either move to suburbs or to other states. Additionally, 39% of the respondents believe that urban multifamily will recover faster than any other commercial real estate sector. These findings suggest that the trend to invest in suburban neighborhoods close to urban centers will fade out. The sentiment is now moving to secondary and smaller cities.

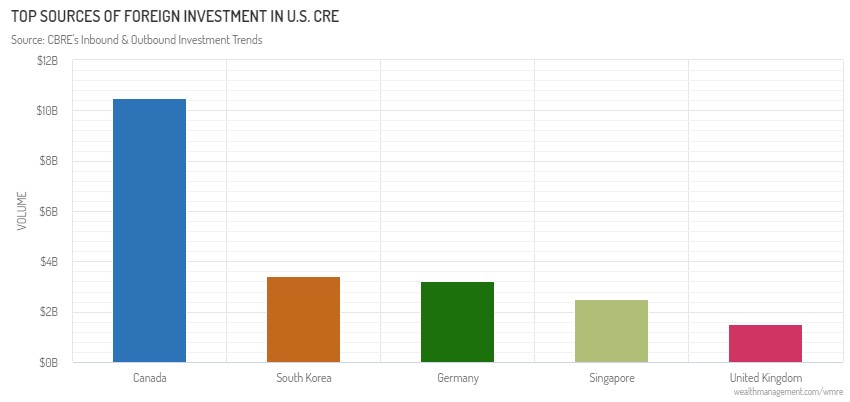

Foreign Buyers Position for CRE Buying Opportunities

Foreign investments in US commercial real estate dropped 31% to a 7-year low of $44.3 billion but is expected to return quickly in 2021. “Investment flows are related to GDP, and we’re in line for a really strong year in GDP growth in the U.S. So, I expect a really strong year for U.S. inbound capital in 2021,” says Richard Barkham, Ph.D., global chief economist & head of Americas Research at CBRE. The top sources of foreign investment are as follows: