Profimex Market Review Update – March 25, 2021

25.3.2021

Manhattan’s Office Market Slump Got Even Worse in Q4

The Manhattan office sector had the highest negative net absorption rate in the fourth quarter of 2020 since early 2009 with 10.6 million square feet. According to a recent report, published by Colliers, Manhattan vacancy rates are on the rise with 8%, while asking rents fell by 3.5% to $75.39 per square feet. Around 24.2% of all office availability in Manhattan comes from sublease space, which is flooding the market and asks for barely $59.64 per square feet. With leasing activity decreasing additional 13.4% from the third quarter, it is undeniable that the office sector in Manhattan is in trouble.

How is Sublease Space Affecting Demand for Direct Office Space?

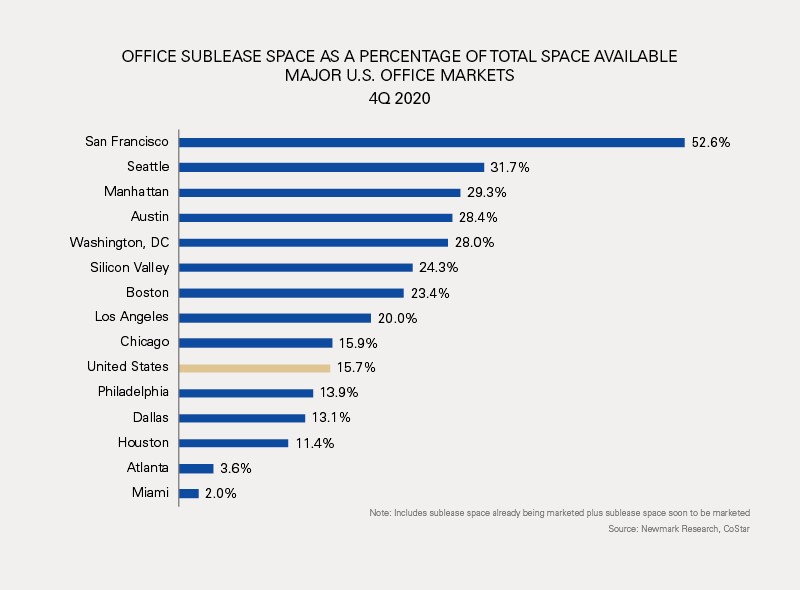

According to a recent article, published by Newmark, “national office market fundamentals continue to face downward pressure from sublease space, which are adding to vacancy and generating negative net absorption in many major markets.” Subleases have historically speaking been a response to economic downturns when companies increase layoffs and downsize their space due to increased uncertainty. The pandemic is no exception. The major markets are Manhattan, Chicago, Los Angeles, and Atlanta, while Boston, San Francisco, and Washington D.C. seem to have reached their peak with some sublease opportunities being withdrawn.